The pre-holiday screen increase list is the first, and now the frequent decline is the first.

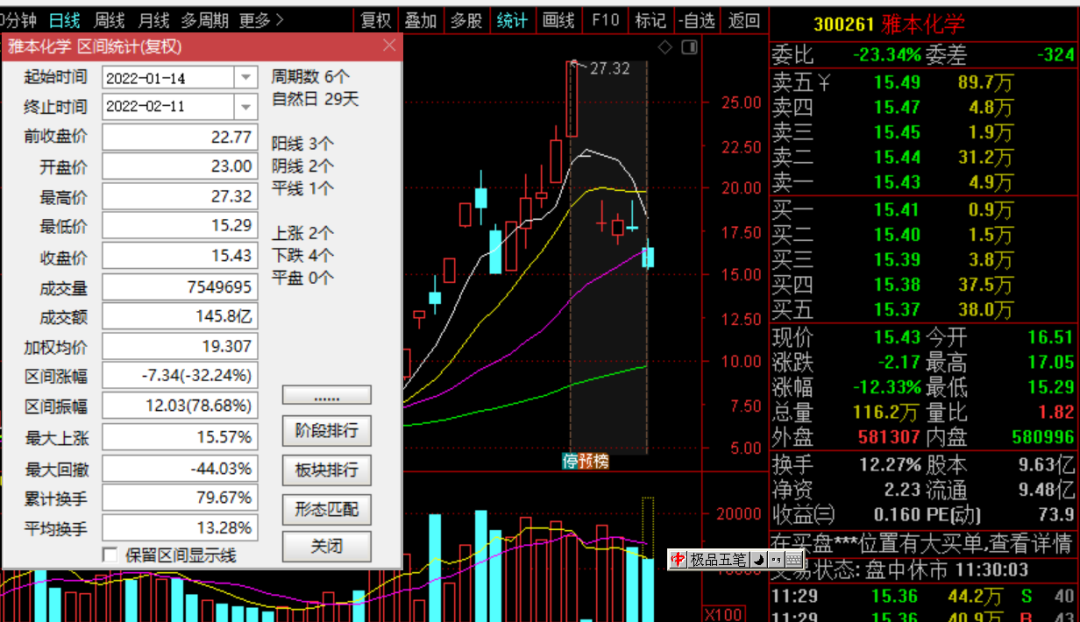

On February 11, Yaben Chemical opened low and went low, with the largest decline of more than 12%, as of the noon close, Yaben Chemical reported at 15.4 yuan, down 12.33%, ranking first in the list of declines in the two cities.

On February 7, the first trading day after the Spring Festival, Yaben Chemical opened down, fell by 17% again on February 8, and just stabilized on February 9, and fell sharply again in the past two days.

In 5 trading days, Yaben Chemical fell by more than 30%, and if it was bought at the pre-holiday high, the retracement reached 44%.

Up to now, the total market value of Yaben Chemical is 14.8 billion, which has shrunk by more than 11 billion yuan compared with the market value of 26.3 billion yuan on the last trading day before the holiday, which is equivalent to an average loss of 280,000 yuan per household according to the calculation of 40,000 shareholders of Yaben Chemical.

Due to the previous surge in Yaben Chemical, not only ordinary retail investors bought a large number of them, but also Fang Xinxia and other roaming funds also entered. On February 8, when Yaben Chemical fell to a halt, it attracted 3 billion funds to pry board, and the trading volume of these trading days after the holiday reached more than 10.3 billion, and now these funds are all buried or cut meat, like Fang Xinxia's blood loss of 50 million to leave, Yaben Chemical was jokingly called the first meat grinder after the Spring Festival.

What exactly happened to Yaben Chemical?

According to the data, the main business of Yaben Chemical includes pesticide intermediates, pharmaceutical intermediates, environmental protection products, etc.

In recent years, the stock price of Yaben Chemical has been relatively sluggish, low than 7 yuan for a long time, and in terms of revenue, Yaben Chemical's revenue has increased from 230 million yuan in 2011 to 2 billion yuan in 2020. As of the first three quarters of 2021, Yaben Chemical's revenue was 1.6 billion yuan, but its net profit in recent years has been almost "standing still", and the net profit in 2018 was the highest point in history of 183 million yuan. As of the end of September 2021, its net profit was 165 million yuan.

The stock price of Yaben Chemical can be speculated in the secondary market, which is inseparable from sticking to the "hot theme".

Last December, the U.S. Food and Drug Administration (FDA) approved Paxlovid, Pfizer's first oral drug, that could be used urgently to treat COVID-19 infections. It is understood that Paxlovid is the first oral antiviral drug authorized by the FDA specifically for combating the new crown virus, and it is urgently approved by South Korea and Europe and other countries. One of the key parts of an intermediate in Paxlovid's API consists of caromanic anhydride.

A month before Pfizer's drug was approved for marketing, Yaben Chemical announced on its official website that "the commercial mass production of the pharmaceutical intermediate caromanic anhydride developed and produced has been smooth, and the current monthly production scale has reached 20 tons".

It is precisely because after being stained with the "Pfizer oral drug concept", Yaben Chemical took off, and the stock price rose from a maximum of 5 yuan to a high of 27.32 yuan, an increase of 446%, that is, more than 4 times.

Due to the sharp fluctuations in stock prices, it has attracted the intervention of regulators. In a letter of concern dated January 5, Yaben Chemicals said: "Caroline anhydride and its derivatives can be used in the process to synthesize Pfizer's new crown oral drug Palo Verde. ”

This reply made the outside world mistakenly think that Yaben Chemical and Pfizer have business contacts, but also rekindled the enthusiasm of investors, from January 10, Yaben Chemical opened a second wave of trend, the stock price gained two 20cm limit, directly pushing The stock price of Yaben Chemical to the highest point.

Subsequently, Yaben Chemical once again clarified to the outside world that the company did not have any cooperation with Pfizer, did not sign a cooperation agreement with Pfizer, and did not supply carophenic anhydride products to Pfizer.

According to public data, as of the end of 2021, the company's sales revenue from carolong anhydride and its derivatives accounted for less than 2% of total revenue.

Yaben Chemical replied to the Shenzhen Stock Exchange's letter of concern, saying that "there is no motivation to rub the hot spot of new crown drugs".

It is worth mentioning that the surge of Yaben Chemical is inseparable from the fuel of floating capital, on January 13 and January 14, the Shaanxi Branch of Industrial Securities, a commonly used seat under the well-known floating capital "Fang Xinxia", bought for two consecutive days, with a cumulative purchase of 160 million. On the first trading day after the holiday, the seat of "Fang Xinxia" lost more than 30 million.

On February 8, the Yaben Chemical Dragon and Tiger List showed that Fang Xinxia lost money, calculated according to the original 160 million, with a cumulative loss of nearly 50 million, and Hangzhou Gang and other free money all left the market. Due to the huge trading volume of Yaben Chemical, it has reached more than 2 billion in recent trading days, and the cumulative transaction volume has reached tens of billions, due to the continuous sharp decline in shares, which means that tens of billions of funds have been buried or cut out of the market.

It is worth mentioning that Wang Xinya, one of the actual controllers of Yaben Chemical, reduced his shareholding by 19 million shares through a block transaction on November 30, 2021, with a proportion of 1.97%, and the amount of the reduction was about 138 million yuan, which was close to the net profit of 173 million yuan for the whole year of Yaben Chemical in 2020.

In the scale Yaben Chemical shareholder group, some investors complained, "The first meat grinder in the Year of the Tiger belongs to it, and it is pitiful to chase the shareholders who have been smothered", "A shares should avoid soaring stocks, it is easy to stand at a high level", "This is to copy the home, and I will never copy the bottom again." "Some investors also questioned: whether the 50-ton Palovide project filing is to facilitate stock price speculation or really for future production, where is the truth?

What do you think of Yaben Chemical, please leave a comment below.