Source: China Economic Network

China Economic Network Beijing, February 17 (Reporter Kang Bo) A share since the beginning of the decline in the market has made the focus on absolute returns of private equity funds suffered setbacks, even adhere to the big consumption of Shenzhen Linyuan Investment Management Co., Ltd. (hereinafter referred to as: Linyuan Investment) has not been spared, from the third-party platform released data show that the yield of Linyuan investment since the beginning of the year is -9.89%, and from its 138 funds with net value since the beginning of the performance, none of them have achieved positive returns.

Specifically, the smallest decline of these 138 funds was 2.23%, and a total of 68 funds fell more than 10%, accounting for 49%, of which 4 fell by more than 20%. The four funds are Linyuan Investment No. 36, Linyuan Investment No. 27, Linyuan Investment No. 32 and Linyuan Investment No. 29, and the latest net value cut-off date is January 28, 2022, but the return on the navigable unit net value since the beginning of the year is -22.17%, -22.14%, -20.96% and -20.79%, respectively. All of these funds were established in 2018, and judging from last year's situation, these funds have performed well, with full-year yields of more than 40%, and their corrections are mainly from this year.

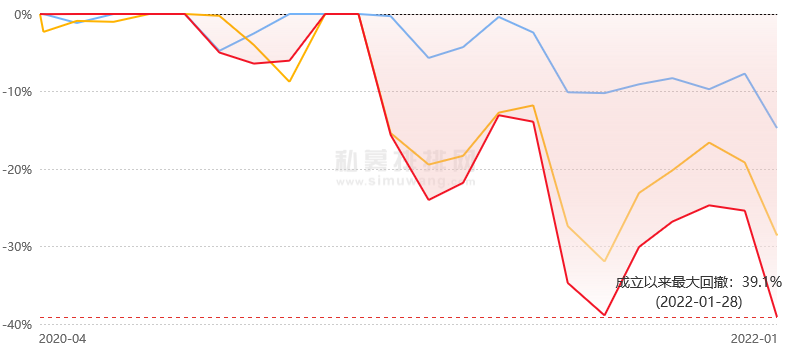

But China Economic Network reporter noted that the trend of many funds under Linyuan Investment is not completely consistent, from the historical performance, the trend of funds established after 2020 is obviously poor, taking Linyuan Investment No. 105 as an example, the fund was established on April 24, 2020, after the rise in 2020, the fund's high point appeared on January 29, 2021, and since then it has been all the way down, compared with several funds established in 2018, Linyuan Investment No. 105 also fell by 19.11% for the whole year of 2021, and recorded a record maximum drawdown of 39.1% on January 28, 2022, and fell by 18.39% since the beginning of January 28. Similarly, Linyuan Investment No. 149, which was established on August 18, 2020, began to fall on February 10, 2021, and hit a maximum drawdown of 35.67% on August 27, 2021, resulting in its full year 2021 rising only 6.09% and falling 7.69% since the beginning of the year.

Linyuan Investment No. 105 dynamic drawdown

Source: Private Placement Network

Founded on May 26, 2020, Linyuan Investment No. 113 has continued to decline by 5.04% since the beginning of this year after losing 11.90% in 2021, resulting in a loss of 5.41% since its inception, and the cumulative net unit value as of January 28, 2022 is 0.9459 yuan.

Linyuan Investment No. 113 historical income trend chart

It is reported that Linyuan was born in 1963, is the chairman of Shenzhen Linyuan Investment Management Co., Ltd., and has worked in Shenzhen Red Cross Hospital and Shenzhen Museum. In 1989, he invested 8,000 yuan in the stock market, in 1992 he achieved an investment income of 10 million yuan by investing in original shares, and after 1992, he achieved tens of billions of investment income by investing in enterprises such as Guizhou Moutai and Yunnan Baiyao.

According to media reports, Linyuan's heavily stocked stocks have included Arowana, Tongrentang, Yili Shares, Lepu Medical, Yunnan Baiyao, Yiling Pharmaceutical, Katazai, Guizhou Moutai, Haitian Soy Sauce, and Zhongxin Pharmaceutical. However, judging from the latest quarterly reports released by listed companies, Linyuan's funds currently only appear in the top ten circulating shareholders of Aotexun and Arowana.

Among them, Arowana is particularly optimistic, from the third quarter of 2021 report, Linyuan Investment No. 166, Linyuan Investment No. 158, Linyuan Investment No. 24, Linyuan Investment No. 130 all hold the stock, although the stock price of Arowana has fallen from the first quarter of 2021, but Linyuan has fallen more and more to buy, Linyuan Investment No. 130 is a new purchase in the third quarter of last year, it holds 909,200 shares, ranking the ninth largest circulating shareholder of Arowana. Linyuan Investment No. 133 and Linyuan Investment No. 132 hold Aotexun, ranking second and third largest circulating shareholders of the stock.

In addition, at the shareholders' meeting held by Zhifei Biology on February 14, Lin Yuan also appeared at the venue and expressed optimism about the future development prospects of Zhifei Biology, but did not disclose the specific number of zhifei biological purchases.

For the current stock market, Lin Yuan believes that A shares have only been disturbed by many factors, but they are still relatively strong, belonging to the beginning of the bull market, there will be some adjustments in the period of "bear and bull", if not adjusted for a long time, it is a real bull market, and investors are encouraged to invest in the long term.

Lin Yuan also told the media recently: "In the long run, there is no problem in investing in medicine and new energy, we mainly invest in consumption and medicine." However, LinYuan stressed: "New energy is a development direction, but we do not invest, we only invest in industries related to "mouth". New energy is encouraged by the state, other countries in the world are also considered in this way, it must be OK, but at the level of which enterprise to invest in, we really can't grasp it, or put risk control in the first place. ”

Linyuan Investment has a list of public performance funds this year

Source: Flush